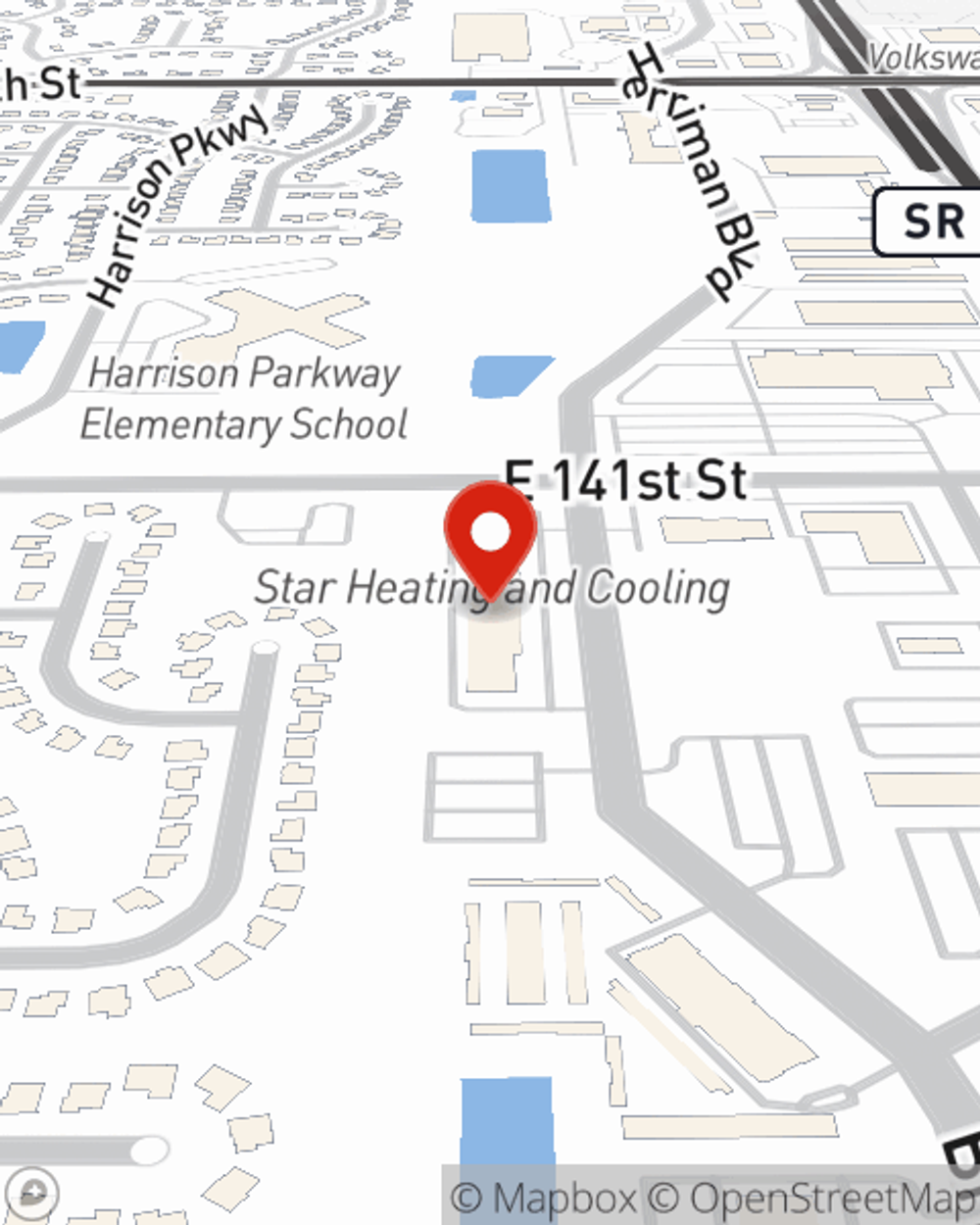

Business Insurance in and around Fishers

Calling all small business owners of Fishers!

This small business insurance is not risky

- Fishers, IN

- Noblesville, IN

- Carmel, IN

- Westfield, IN

This Coverage Is Worth It.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's an art gallery, a cosmetic store, a pharmacy, or other.

Calling all small business owners of Fishers!

This small business insurance is not risky

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, commercial auto or builders risk insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Ritchie Deaton is here to help you discover your options. Visit today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Ritchie Deaton

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.